At the Association of American University Presses Annual Meeting on June 18, 2016, I will facilitate an industry mastermind discussion on strengths, weaknesses, opportunities, and threats (SWOT) in scholarly publishing from a start-up business perspective.

At the Association of American University Presses Annual Meeting on June 18, 2016, I will facilitate an industry mastermind discussion on strengths, weaknesses, opportunities, and threats (SWOT) in scholarly publishing from a start-up business perspective. In particular, we’ll explore how the publishing industry—in particular, the scholarly/university press publishing segment—has performed over time. By way of background, I thought it might be helpful to provide some of that data regarding the broader publishing industry in advance of the meeting to get the conversation started.

For tax and economic reporting purposes, the US government utilizes the North America Industry Classification System (NAICS) to segment industries within the US economy. The keyword search term “publishing” at www.naics.com produces three key horizontal industry segments in publishing:

- NAICS Code 511130: Book Publishers (except exclusive Internet publishers)

- Organizations that design, edit, market, and distribute books

- Why separate Internet publishing?

- NAICS Code 511120: Periodical Publishers (except exclusive Internet publishers)

- Magazine, journal, or other periodical publishers

- Do these publishers support professors adequately?

- NAICS Code 519130: Internet Publishers

- Publishers that provide text, audio, and/or video content on the Internet exclusively

- Publishing and/or broadcasting content on the Internet exclusively or

- Operating websites

- Publishers that provide text, audio, and/or video content on the Internet exclusively

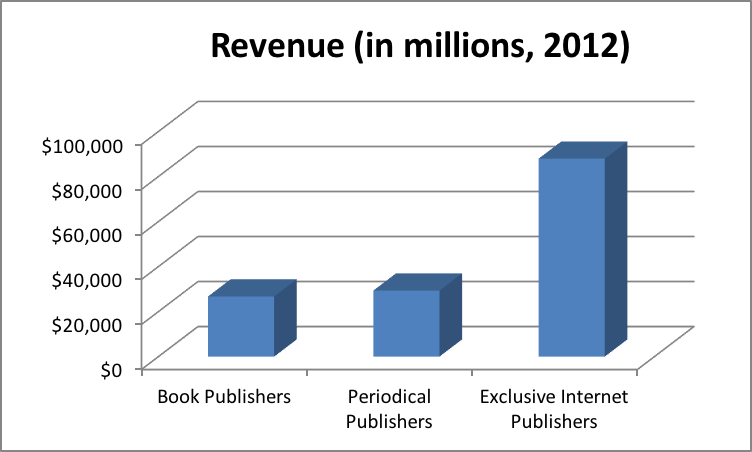

Why does NAICS separate exclusive Internet publishers? Following the logic of the NAICS, exclusive Internet publishing has grown enough to warrant its own industry classification. In fact, the Exclusive Internet Publishers segment generates three times the revenue of both Book and Periodical Publishing segments and employs twice as many people.

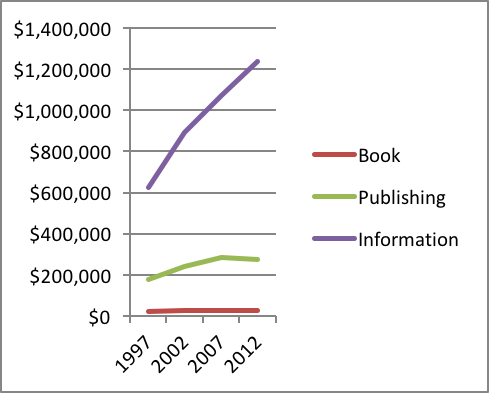

The aforementioned NAICS “industry” codes contain five digits and represent a horizontal view of the publishing industry. Next let’s review the publishing industry both vertically and more broadly using only two- and three-digit NAICS codes. The NAICS code for Book Publishing contains three levels of categorization. The first is the industry sector Information (NAICS code 51). The second is the subsector Publishing (NAICS code 511). The third level is Book Publishers (NAICS code 51130), which is the best fit for most university presses. Using data from these three market segments, let’s analyze the data points using compounded annual growth rates (CAGRs). What does the CAGR analysis tell us?

- The number of firms is flat for Book Publishers and decreasing in Publishing and increasing in Information—by the same amount, respectively.

- Revenue in Information is growing 4.5 times as fast as that of Book Publishing.

- Payroll expense is growing by double digits across all Information and Publishing segments.

- Workloads have increased per employee as evidenced by increasing payroll per employee.

- Book publishers need to understand what information customers are willing to pay for.

If you are feeling overworked in Book Publishing, the data confirm this feeling. If you feel underpaid, the data suggest otherwise (sorry). Payroll is growing at 9.1 percent and revenue is growing at 4.2 percent while total employment is declining at 5 percent, compounded annually. Furthermore, revenue per employee increased to 9.7 percent annually. This means that employees are becoming productive (more revenue per employee) and being paid more per employee.

The revenue trends across Information, Publishing, and Book Publishing tell a clear story, as we can see in the chart below:

Clearly, people have been buying more from the parent Information sector and at a higher growth rate over the last fifteen years than from either the Book Publishing or Publishing subsets, which have remained relatively flat. As we view this revenue trend chart, we should wonder what’s happening in the Information industry that is generating such consistent annual growth. When we break down the subsectors and compare revenue trends, here’s what we see:

- Recordings had flat growth.

- Telecommunications had slow growth.

- Broadcasting, Data Processing, and Data Hosting had fast growth.

- Other Information Services had exponential growth.

Anecdotally, within Other Information Services, revenue in the Libraries and Archive industry is, in fact, growing. Of course, as will be no surprise to anyone, the Internet Publishing, Broadcasting, and Web Search Portals have the fastest growth. Look for more industry segmentation here when the NAICS updates economic activities next for 2017.

As we prepare for our SWOT analysis mastermind industry discussion, we should be curious about what is growing and why. Economic activities data inform us that information in nontraditional forms present opportunities for growth. If university presses continue to provide information in traditional ways, such as books and periodicals, then they should not expect growth. Why is growth necessary even for small, mission-driven nonprofit organizations? First, to ensure that revenue grows sufficiently to match growth in expenses such as pay raises. Second, in this case, publishing industry data reveal that book revenues are flat and people are demanding information in forms other than books. Your strategic business plan to keep your university press sought-after by and relevant to your stakeholders should account for these trends even if growth is not the objective in and of itself. Eventually change will be unavoidable. Whether growth or adaptation is the objective, let’s discuss what valuable information a university press might offer that people need. My intention is to facilitate a constructive discussion that will benefit both you and your university press. I’ll see you in Philadelphia.

John J. McAdam is the author of The One-Hour Business Plan (Wiley), an instructor in Strategic Business Planning at the Wharton Small Business Development Center, an association workshop speaker, and a business advisor. For more information, visit:

- https://twitter.com/johnjmcadam

- https://www.linkedin.com/in/john-j-mcadam-80123957

- http://www.theonehourbusinessplan.com/

- http://pioneerbusinessventures.com/